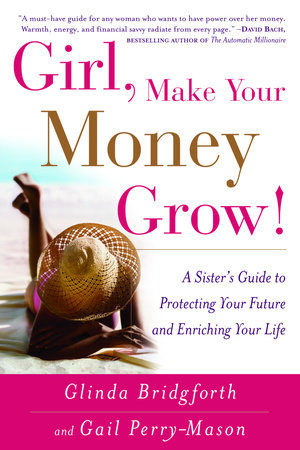

Author Q&A

Glinda Bridgforth recently took some time to discuss how to start saving, seasonal spending habits, and how self-esteem can change the way we spend.

1. Both your new book and your previous book, Girl, Get Your Money Straight!, take a holistic approach to financial health. What’s different about this approach?

The holistic approach goes beyond looking at money from a pure practical standpoint –dollars and cents or income versus expense. It also integrates emotional, spiritual, and cultural issues that play into why we behave with money the way that we do. By identifying our beliefs and attitudes about money, we are able to get in touch with our core issues and address the heart of our financial difficulties. Most people know intellectually what they should do to better manage their finances–spend less and save more. But what they can’t understand is why they don’t do it. The holistic approach helps you explore the messages from childhood that formed your belief systems about money and helps you examine the motives behind your emotional and impulse spending.

2. What holds most people back from investing?

Fear is a huge factor; fear of making a mistake, doing it wrong, and losing money. Procrastination is another reason. Most people feel they lack the knowledge to start investing and put it off until they have time to learn more about it. Unfortunately, many wait too long and end up wasting valuable time and money–money that could be working for them instead of them continuing to work for money. Belief that they don’t have resources to invest is another thing that holds people back. They feel that they can’t afford to risk putting money into an investment, but, in fact, they do take risk because they’re willing to regularly play the lottery or play the casino slot machines.

3. Over the past two years, we’ve seen some pretty disastrous newspaper headlines: retirement funds dramatically losing their value, terrible investment results. What are some safe options for people wishing to invest?

You have to understand the principle of investing: the higher the return, the higher the risk. So determine your risk tolerance as you decide where to make your investment. Can you sleep at night if you lose 10 percent of your investment? How about 15 percent or 20 percent? Do your homework and research as thoroughly as possible any potential investment. Then make sure you diversify. If you’ve diversified properly, you can be reasonably assured that should one of your investments go down, another one will be up so overall things can balance out. Finally, be patient. Go slow. Take on more risk as you learn more about the market. Understand the benefits of being in it for the long haul.

4. Have you any advice for people who want to begin saving for their future later in life?

My advice is to start now by making the maximum contribution yearly to your retirement plan–whether it be your company’s 401(k), 403(b), or open an IRA, SEP, or Keogh. Anything you can put away for your future will be helpful, and it’s better to have something put away than to have nothing. If you are starting later in life and have to play catch-up, assess where you currently stand financially and determine how many years you are willing to put some concerted effort into working hard. Having that target date makes things a little more bearable. By choosing to spend your money differently and focus on “growing” your money, you will eventually realize that the sacrifice is worth it.

5. After paying for the basics–rent or mortgage, food, the daily commute to work, the monthly bills, there sometimes doesn’t seem to be much left over for investing. Any advice here?

At some point, you’ll need to look at things through a wide lens and not limit your thinking in terms of what constitutes an investment. It could be investing in your education–taking some classes–to make yourself more marketable for a promotion. It could mean foregoing the health club and cable television expense in order to qualify for a mortgage so you can stop renting and astart building some equity. Our lives have changed so dramatically over the last ten to fifteen years that there are many things that we have come to regard as necessities which, in fact, are luxuries and don’t constitute as “basic” living expenses. You don’t necessarily need hundreds of dollars to get started investing. Even saving the change from your purse or pockets at the end of each day could add up to twenty or thirty dollars per month. There are investment vehicles available where you can contribute such an amount and start to make your money grow.

6. Sometimes the hardest thing is just getting started. How do you suggest people begin?

First, make a spending plan or budget as some people call it, so you can anticipate where you need to spend money in the upcoming month. Next, write down every cent you spend over the course of the month and total it so you can determine how comfortable you are with where your money goes. Focus on laying a solid foundation by paying off or at least significantly paying down your debt. Make sure you are insured properly to protect the assets you currently own. Invest in your company’s retirement plan, and start to build a savings cushion for a cash reserve. Ideally it’s great to save six to eight months’ worth of your living expenses set aside in case you lose your job. But if that sounds overwhelming, as it likely will, focus on saving one or two months’ living expenses. Also consider home ownership as a source of security for your family and as a worthwhile investment. Finally, after these things are taken care of, determine how much you can afford to earmark monthly for your stock market investments.

7. Are there any specific challenges that African Americans face in building an abundant future?

In my financial counseling practice, lack of self-esteem is the most common problem I see with people of all ethnicities. It effects how they spend money. If they feel sad, lonely, or depressed, they tend to spend money to medicate themselves. With African Americans, because we are subject to overt and covert discrimination on a daily basis, as well as having a history of oppression, it often makes us feel inadequate or insecure. In an effort to boost our self-esteem, African Americans will spend excessively and live above our means in order to show visible signs of success and try to measure up. Often it is at the expense of creating an abundant future.

8. For many people, the holidays can create a big financial burden. Do you have any tips for getting through the holidays without breaking the bank–or maxing out that credit card?

Ideally, you want to start early and set aside a certain amount of money each month to cover holiday shopping without using your credit cards. But regardless, you definitely want to start by examining your motives for spending. Are you doing it to meet someone else’s expectation? Are you trying to “keep up with the Joneses?” Are you trying to compensate for your own childhood deprivations? Get clear on that issue before you get started. Next, determine the amount of money you can reasonably afford to spend without creating financial drama for yourself in January. Once you’re comfortable with that amount, develop your holiday spending plan. List the names of everyone you intend to buy gifts for and the dollar amount of each gift. List all of the additional things you’ll need to purchase or spend money on, for example, food, decorations, and entertainment. Now add everything up. If this amount exceeds the amount you decided you could reasonably afford, go back through your list and start to trim a few dollars from each name until you make the totals equal. It also helps to use cash when shopping and the “envelope system.” This is where you put the appropriate amount of money planned for each person’s gift in an envelope with their name on it. When you go out to shop, you make a commitment to only spend what’s in their envelope. This way you stay within your limit or you realize that you’ll be shorting someone else if you overspend.